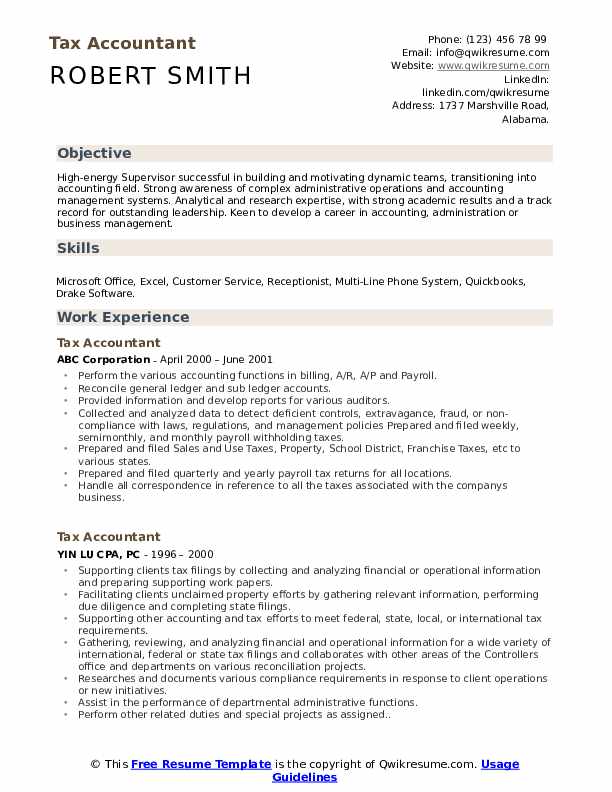

Sales tax accountants make sure that businesses pay the right amount of sales tax to the government. Accounting schools earn your accounting or advanced degree.

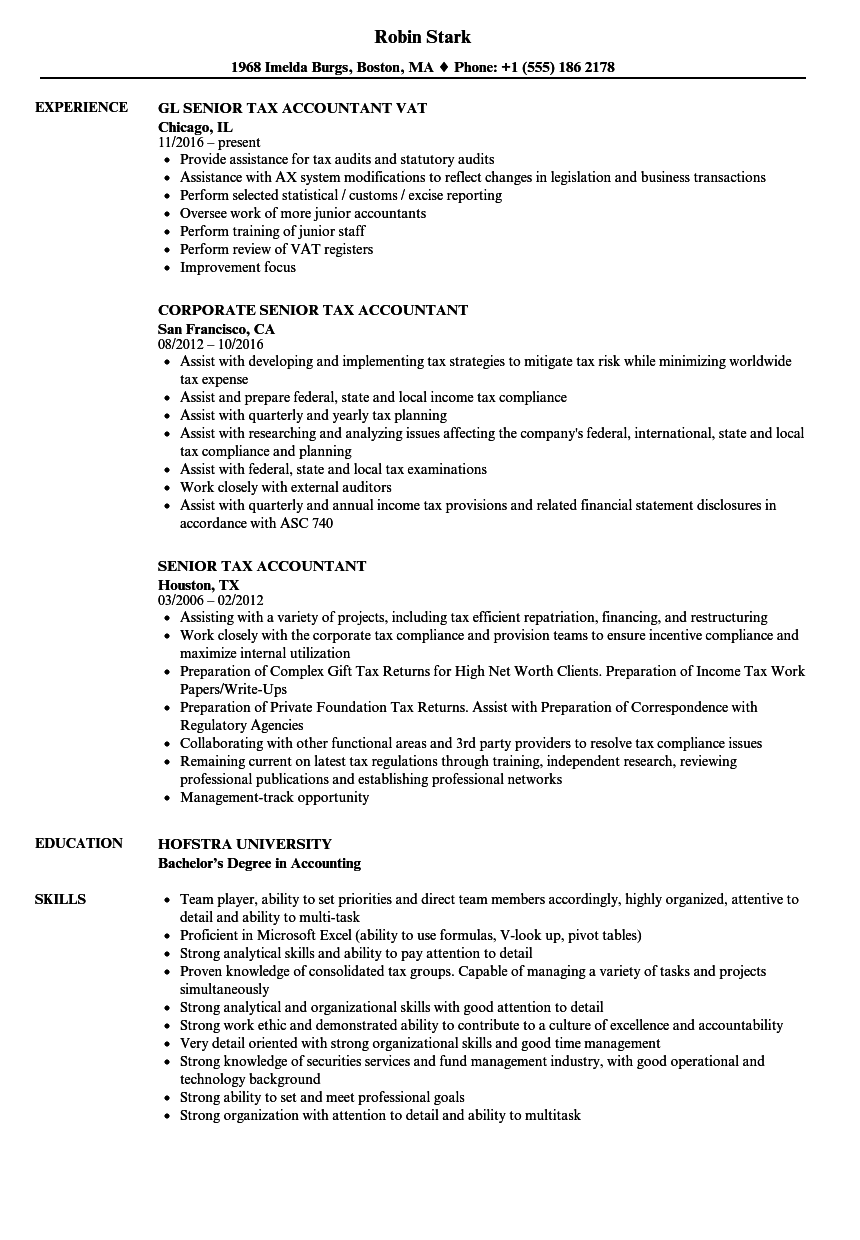

Senior Tax Accountant Resume Example Ernst And Young Llp

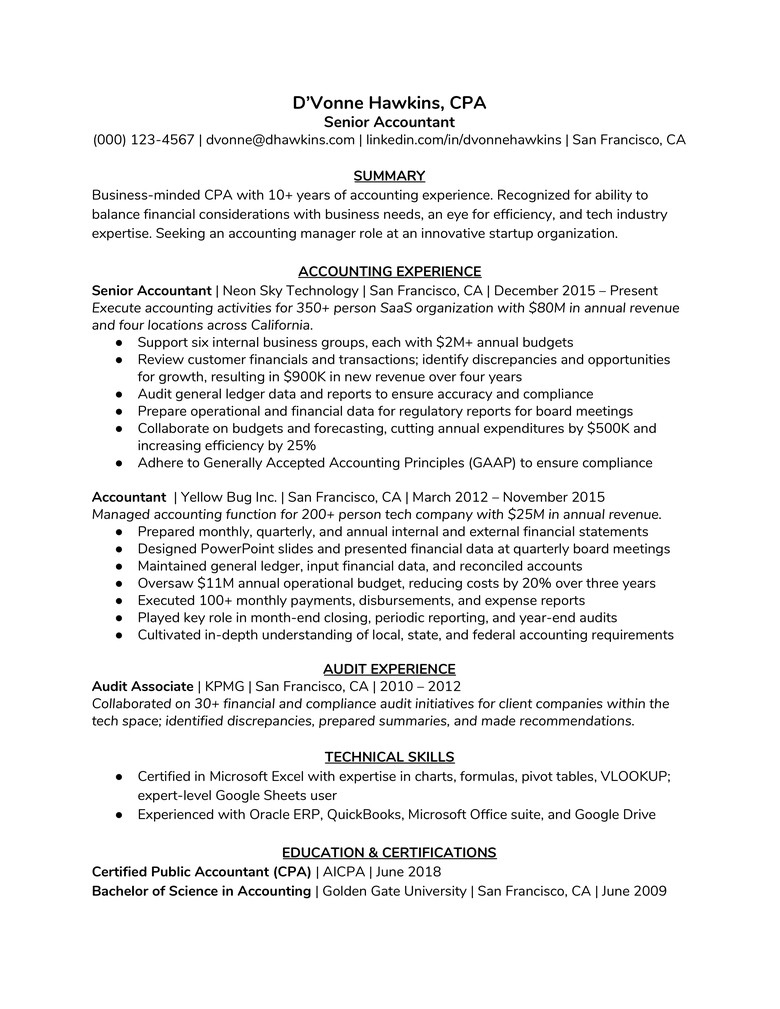

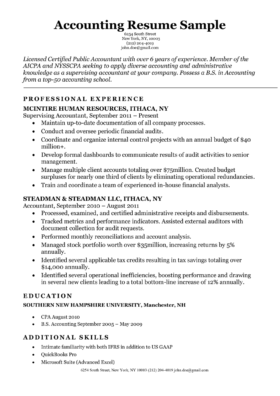

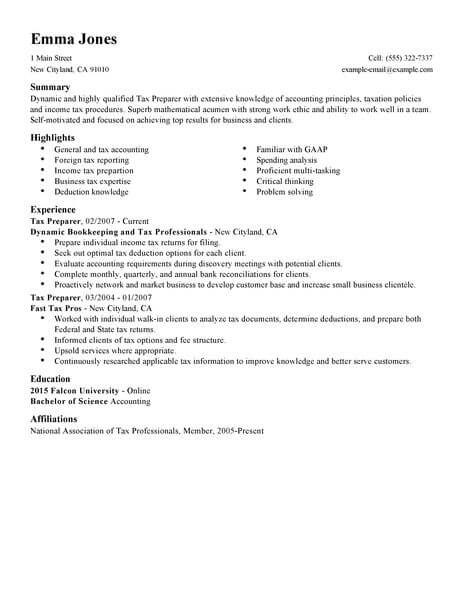

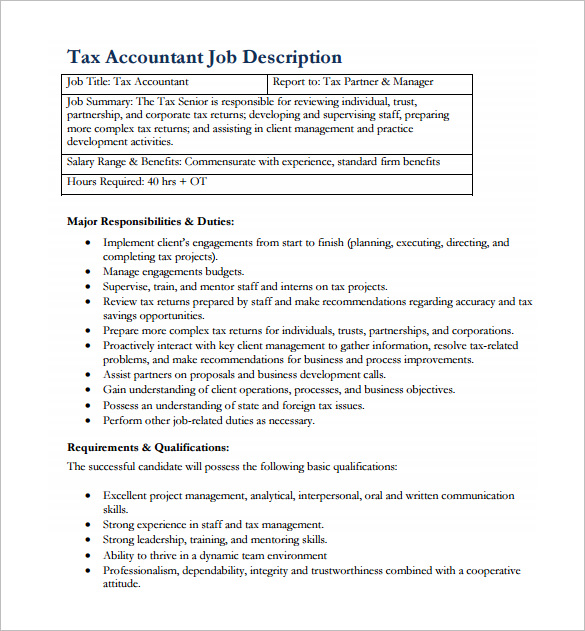

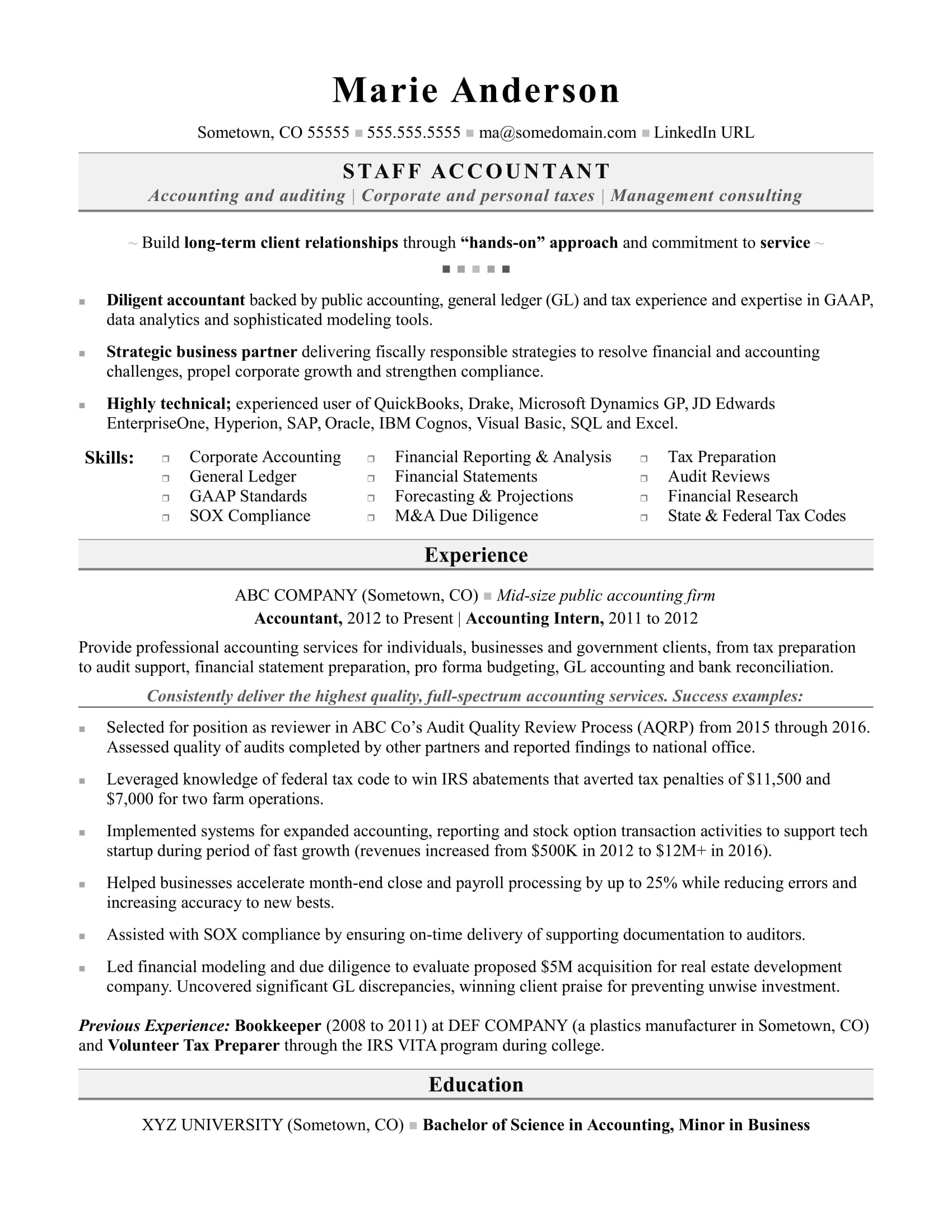

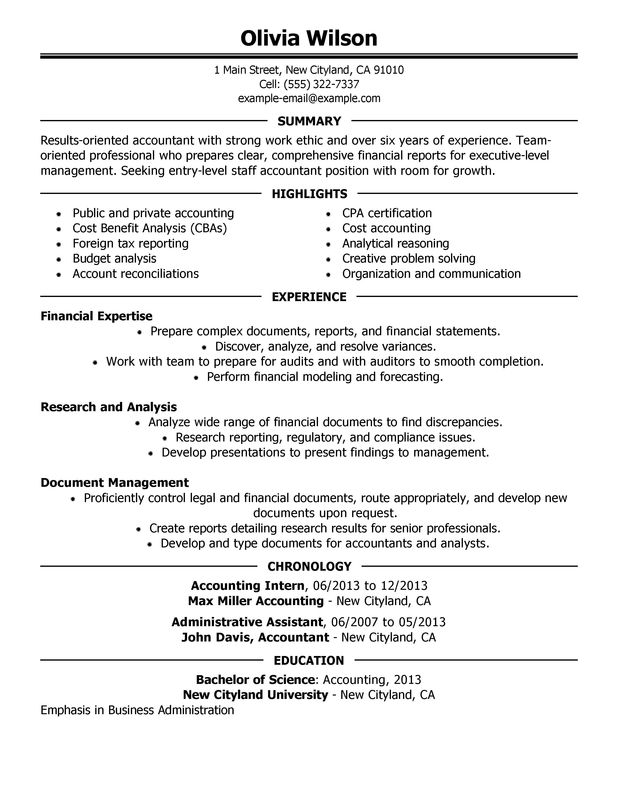

Tax accountant job description resume. Typical duties listed on a sales tax accountant resume are checking sales records reconciling sales with the right tax rate implementing tax accounting policies filing the companys taxes and updating their knowledge on tax rates. Resume distribution post your resume to over 85 job boards automatically. Our accountant specific resume examples will help you craft the resume you need to impress accounting firms and win you the job. Accountant job seeking tips. You can easily customize this template to add any accountant duties and responsibilities that are relevant to your company. Accountant job description.

A tax accountant also looks after providing advice on financial and tax matters and should have an in depth knowledge of the regulations laws and acts that govern this process. Let prospective accountants know exactly how to apply whether its clicking the apply button on this posting or submitting an application and resume to someone at your company. Vp tax direct reports. They prepare financial reports regarding revenues expenses assets and liabilities for internal use by staff and to meet requirements by the government shareholders and other external entities. Looking for a career as an accountant. By reviewing job description examples youll be able to identify what technical and soft skills credentials and work experience matter most to an employer in your target field.

Tax accountant job description guide a tax accountant is responsible for analysing fiscal matters and preparing submitting and managing tax statements and returns for businesses and clients. Primary responsibilities maintain required level of technical knowledge. This accountant job description template is optimized for posting on online job boards or careers pages. Call to action here is where the most effective job descriptions include a strong call to action turning job seekers into actual applicants. Post now on job boards. Prepare estimated federal and state income tax payments.

None areas of responsibility. Provide general ledger system support regarding functional issues of financial and management reporting. They are employed both in a range of private industries and the public sector. Responsibilities shown on example resumes of senior tax accountants include preparing corporate partnership fiduciary and complex individual returns. Accountants collect organize and track financial information for organizations. Accountants are always needed by all kinds of businesses.

Preparing formal responses of state and federal tax notices and reviewing individual tax returns and payroll tax returns. Senior tax accountants oversee a team of tax accountants who assist clients with their financial and income tax statements. Resume writing service have our experts create a job winning resume. In order to ensure your professional resume will support your goals use this accountant job description to inform what you should highlight on your resume.

:max_bytes(150000):strip_icc()/2062348v1-5bc77de3c9e77c0051c6cdab.png)