They publish more information on self employment in the netherlands. A cv is not a legal entity under dutch law.

Sadekya Dutch C V

Dutch cv legal entity. 2 the dutch foundation is not an entity designated to conduct a business and as general partner will not conduct any other business. In international tax planning the commanditaire vennootschap or cv is the most commonly used. The cooperative will then be comparable with an ordinary dutch limited liability company bv or nv. Therefore legal title to the cv assets is held by the general partner for the risk and account of the cv. Commanditaire vennootschap or just cv has no legal personality and can be formed by two or more naturallegal persons. Although the zzp form is not a legal entity the term is commonly used.

You must report your changes to the dutch chamber of commerce and the dutch tax and customs administration. It cannot hold legal title to assets. The cv is a widely used vehicle to collectively fund real estate dutch movies more recently wind mill parks and the like. Doing business in the netherlands is an english language site operated by the dutch government. In 2012 dutch company law was simplified as a result of which the procedure to incorporate a dutch bv has become more easier and the cost of incorporation have significantly reduced. You will find that dutch legal entities have a lot to offer.

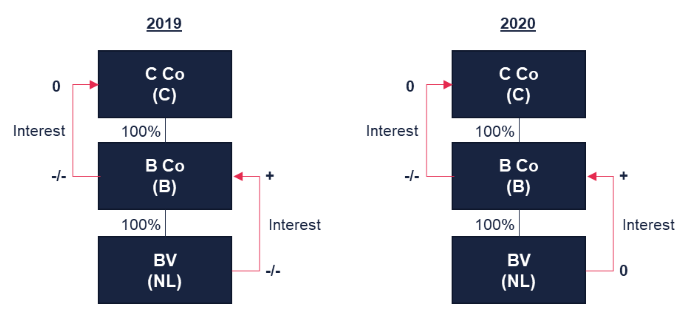

Most often business entities are formed to sell a product or a service. A cv into a different legal structure such as the general partnership vof or sole proprietorship. 1 the cv is not a corporate entity. Limited partnership cv like the general partnership the limited partnership in dutch. Since the cv is not a legal entity it is not possible for the cv to own goods. Cv is not taxed on this income because cv is subject to neither dutch nor us corporate income tax due to a mismatch in the classification of cv.

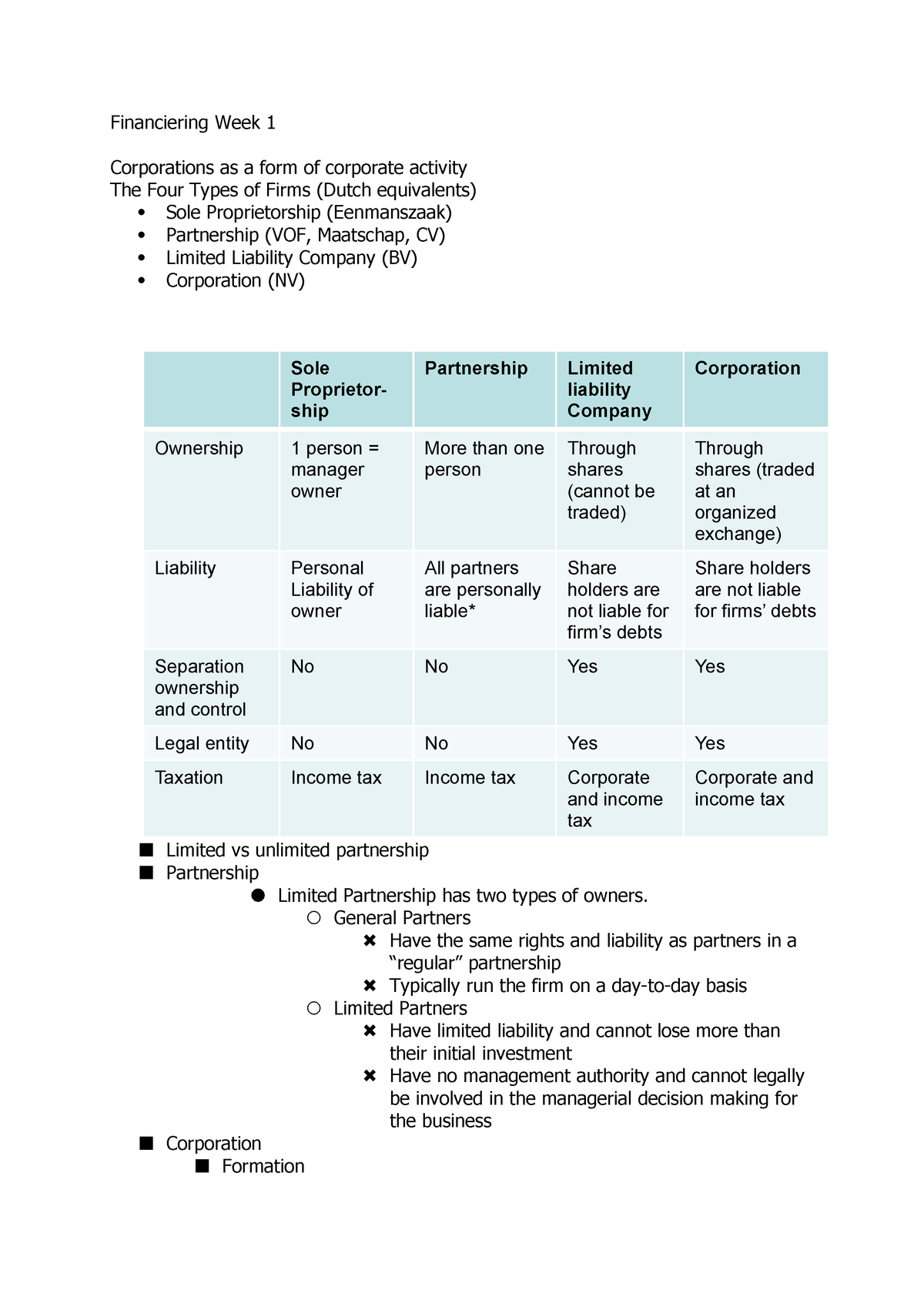

Cv a limited partnership is a business run by more than one person. This means that the income of cv is not taxed by the netherlands at the level of cv. Legal characteristics of a cooperative. Every legal entity has its pros and cons with regard to tax planning. Is the most frequently used legal entity in the netherlands for conducting business activities. The cooperative association in dutchcoöperatieve vereniging can be incorporated as a legal entity with limited liability for its participants members in legal terms.

Citation needed there are many types of business entities defined in the legal systems of various countries. A business entity is an entity that is formed and administered as per corporate law in order to engage in business activities charitable work or other activities allowable. The partners can either be legal persons or natural persons. It is an partnership agreement between one or more general partners and one or more limited partners. According to dutch tax law cv is a transparent entity and therefore not liable to dutch corporate income tax. In this article we will discuss the.